Enjoy configurability when you design and build your insurance products and user interfaces to complement your unique offerings. Developed by insurance professionals for insurers, mutuals, managing general agents (MGAs) and brokers with programs, our software offers an exceptional end-to-end product design experience without any coding or development knowledge needed.

Get a Demo

Get a Demo

Key Features & Functionality

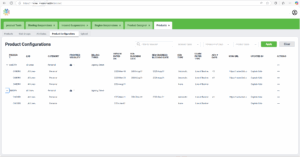

The Product module is where you configure your insurance products, customizing every aspect with assistance from our team. The comprehensive rules engine and extensive rating engine allow you to fully control eligibility and pricing while our automated document and renewal management can make your workflows more efficient. Plus, you have total control over product delivery and binding suspensions.

End-to-End Product Design

- Configure your coverages, risks and risk groups

- Set definitions using questions and conditions

- Build role-based user interfaces.

- Design your documents (which you can upload with version tracking)

- Customizable declaration and quote pages

- Set new and renewal effective dates

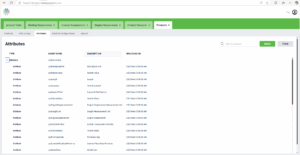

Comprehensive Rules Engine

- Build out the rules integrated with your definitions to refer or determine eligibility

- Tap into our comprehensive rules library for simple or complex rules and documentation

- Manage dates using rules

- Create unique user messaging for each rule

Extensive Rating Engine

- Risk group level rating including algorithms, factors and initial rates

- Conditional automated surcharge and discount calculations

- Adapt pricing strategies to meet market demands and regulatory requirements

Postal Code-Based Grouping

- Used for rules, rating and reinsurance

- Unlimited configurable zones, tiers or territories

Automated Documents Management

- Individual and bulk wordings with new and renewal effective dates

- Version wordings and links to coverages, risks, risk groups and products

- Configure your documents to list wordings for quote proposal and declaration pages

- System-generated conditional wording packages for new business and renewals

- Policy change documents include updated wordings and regenerated wording packages, if applicable

Renewal Management

- For each product, set and version the renewal type: automatic, manual or none

- Override product level renewal settings to issue individual renewals with permission

- Configure the days in advance for automated renewals

- Utilize a new or renewal blocking date by product to prevent policy issuance while product or contract changes are pending

Total Control Over Product Delivery

- Each product can be configured for visibility by province in our Policy, Gateway and Gateway+ modules

- Choose to restrict billing type by product

- Build the insurance application process and premium finance agreement process for each product by transaction type

Binding Suspensions

- Overlay all products with insured or region binding suspensions

- Insured suspensions canbe converted, entered or integrated with third party sanctioning

Map-Integrated Risk Entry

- Manual risk location entry just got smarter with integrated maps

- Use coordinates dynamically in product rules

Benefits of the Product Module

Your MGA, brokerage, carrier or mutual can benefit from the Product module and Modular Solutions platform because we offer something truly innovative while maintaining affordability.

Enhanced Efficiency

Automate routine tasks and processes, improving accuracy and your team’s efficiency while reducing overhead.

Stay Competitive

Stay ahead of the competition with a software solution that is truly innovative, offering superior service to your broker and agent partners.

Scalability and Flexibility

Modular Solutions is completely configurable to your requirements and workflows. You can easily adapt to the changing needs of your business with a flexible and scalable solution that grows with you.

Affordable for Small and Mid-Sized Companies

Our powerful software is affordable for brokers with programs, MGAs and small to mid-size insurance companies and mutuals.

Designed by Industry Experts

We were insurance professionals first so we understand the nuances and challenges of the insurance industry. Our team developed software that solves legacy platform problems.

Want to see the Product Module in action?

Leverage Integrations with the Solutions Exchange

Enhance your user experience through our Solutions Exchange partners. Seamless API integration with third parties extend the capabilities of our platform in areas such as accounting, evaluators, data analytics and more.

Learn more about the Solutions Exchange here >

Frequently Asked Questions About the Product Module

Here are some answers to our most frequently asked questions about the Product module.

Can the Product module accommodate various types of insurance products?

Yes, Modular Solutions is designed for all property and casualty insurers, mutuals, MGAs and brokers with programs. The Product module can accommodate all personal, commercial and specialty insurance products. We do not currently support benefits insurance products such as life, health and dental.

How flexible is Modular Solutions in terms of eligibility and ratings?

It’s completely customizable. You set the terms of eligibility using our rule and rating engines. You build out the application questions and setup automated underwriter referrals.

How does the deployment process work for new or updated products?

New products being deployed can be versioned based on new and renewal effective dates.