The Insurance Industry’s Most Holistic Software

Nine fully integrated modules empower you to manage your entire operations efficiently and effectively through a single software solution.

Get a Demo

Get a Demo

100%

Implementation Success Rate

95%

Reduction in Processing Time

35%

Improvement in Underwriting Efficiency

20%

Increase in Automated Renewals

A Configurable & Scalable Solution

Designed to be nimble and affordable for small to mid-size insurance carriers, mutuals, MGAs, and brokers with programs, our platform is completely configurable and scalable. Reduce operational costs, streamline and automate processes, leverage your data, and stay competitive in today’s market.

Contact Us Today >

Our Modules

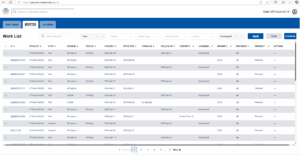

Manage your policyholders, underwriting and day-to-day work throughout the entire policy life cycle with our comprehensive Policy module. The main features include:

- Storage and management of all client details and documents

- Management of the entire policy life cycle including submissions and proposals

- Automated generation of applications, certificates, declarations and wordings

- Manage work-in-progress, activities, payments and claims

Policy Module >

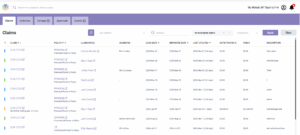

A full cycle claims management module that is fully integrated to the policy. Ensure a smooth claims experience and leverage your claims data for accurate reporting.

- Manage the entire claims process including notice of loss, reserves, recoveries, salvage, and settlements

- Assign and manage third-party adjusters, vendors, additional claimants, and reinsurers

- Automated reserve adjustments and granular tracking of all financials

- Manage balances, payments and approvals

Claims Module >

Design your insurance products end-to-end with complete configurability. We offer comprehensive rules and extensive rating engines, configurable interfaces and more.

- Leverage integrations for data collection such as evaluators, water peril scoring, fire protection, binding suspensions and more

- Automated wordings management and rendering for new business, renewals, endorsements and more

- Control existing and new product delivery and versioning

- No-code product changes enabling your team to be responsive to the market

Product Module >

Empower accounting teams to manage your financials with the Finance Module. Real-time integration with leading accounting platforms, payment processors and premium financing paired with the financial management tools you need to make oversight and execution easy.

- Full financial configuration for your chart of accounts, journal rules, fees, and taxes

- Integrated payment processors and premium financing

- Reconciliation of A/P and A/R

- Full integration to desired accounting software

Finance Module >

Relationship management of your capacity provider or reinsurer. Here you can manage and track your contractual obligations while assigning capacity manually or automating assignment based on rules.

- Set up contracts with your capacity providers, including commission parameters, aggregates, contract numbers, sections and dates

- Manage contracts including renewals and other contract changes

- Utilize our rules engine for capacity assignments and claims recoveries

- Real-time data and production of bordereau, reporting and data analytics

Reinsurance Module >

Leverage a thoughtfully structured data warehouse with a suite of standard reports or customize your own for the exact data and reports your business needs.

- Suite of standard reports – sales, operations, underwriting, finance, claims, and reinsurance

- Automated reporting and customized bordereaux reports tailored to each product

- Real-time access to your data warehouse to analyze for actuarial and reporting purposes

- Lloyds of London Lineage integration for bordereaux reporting

Intelligence Module >

Providing broker and agency partners with a branded portal experience for policy management – everything they need to sell and manage your insurance products. We also offer Gateway+, which is a self-serve link on your partners’ websites for real-time quoting and issuance directly to their consumers.

- User friendly broker portal for distribution, changes, renewals and cancellations, with automated application, declarations and wordings

- Brokerage and agency self-administration of their employees and roles within their offices

- Broker/agent management of work-in-progress, payments, claims, pink cards, certificates and more

- Direct-to-consumer quote, bind and issuance of your products through Gateway+

Gateway Module >

Streamline and enhance the way you manage your relationships with brokers and agents with the Stakeholder module.

- Setup and manage brokerage/agency hierarchy with flexibility and ability to handle complex many-to-many relationships between offices and broker codes

- Manage brokerage and agency relationships with activities, documents and alerts

- Manage automated email document distribution and communication

- Facilitate broker/agent transfers and billing type changes for your brokerage/agency partners

Stakeholder Module >

This module enables you to effortlessly configure and manage your settings and company details, ensuring your operations run smoothly.

- Employee setup and management, including roles, permissions and grouping

- Set up automated activities and email event triggers and manage visibility for work-in-progress and follow-ups

- Manage the setup and configuration of your business

- Add primary business information and levels within your organization

Admin Module >

Our insurance software is…

Configurable

Configurability and flexibility to design your products and interfaces for your customers and employees.

Able to Handle All Lines of Business

Handles all lines of business including but not limited to personal, commercial, agricultural, recreational, specialty and more.

Automated

Streamline processes and workflows to improve efficiency, reduce FTE and bring down operational overhead.

Data-driven

Leveraging data to make informed business decisions, refine products and underwriting, and share results.

Business-friendly

No programming required, with user-friendly interfaces. Our embedded AI assistant, Modi, makes your processes easier and faster.

Responsive

Make real-time changes to rates and rules to adapt to the market.

Holistic

Manage all aspects of your business and the full policy life cycle.

Integrated

API connectivity between modules and with third-party providers.

Built to Handle Industry Complexities

Providing the features and functionalities to handle complexities in product, underwriting and subscriptions for all lines of business.

Clear to Implement

Manageable implementation timeline providing speed to market and low total cost of ownership.

Conversion-friendly

Ability to convert with multiple options that suit your business.

Built with Secure & Scalable Architecture

Cloud-hosted, service-based architecture providing security and scalability.

Are you ready to go modular?

Solutions Exchange

Enhance your capabilities and further expand our holistic platform with third-party API integrations. We’ve partnered with companies providing lead management, marketing, credit checking, sanctions, accounting solutions and so much more.

See our Solutions Exchange partners >

Industry Memberships & Partnerships

We believe strong partnerships make the insurance ecosystem better for everyone. We’re proud members of the Canadian Association of Mutual Insurance Companies (CAMIC) and the Canadian Association of Managing General Agents (CAMGA). Through these partnerships, we help mutuals and MGAs innovate, adapt, and thrive in a competitive insurance industry.

Services & Support

Our Canadian team of insurance and technology experts are here to assist with implementation and provide ongoing support, ensuring your success.

Custom Development

Our development team will scope and determine the feasibility of all custom development requests and inflow to our team if deemed viable.

Product Build & Design

Our product designers will assist you with building your products including rates, rules, underwriting guidelines, and user interfaces to publish those products in your instance of the Modular Solutions platform.

Data Migration & Conversion

Our team will work with you to develop a plan for the migration of your existing data onto your new Modular Solutions insurance software.

Training

Once you are onboarded, your modules are configured, and your products are built, our team of professionals will start training, ensuring you get the most out of your investment. We follow a “train the trainer” model and provide full documentation and training videos that are updated regularly.

Trusted by:

Modular Solutions Technical Overview

Cloud Hosted

in Canada with Tier 3 infrastructure and full redundancy. Your data is securely stored and backed up, meeting stringent compliance and availability standards. Unlimited data storage – enjoy secure, scalable hosting with no data limitations.

API-Driven

Easy integrations and extensibility of the platform to value-add third-party providers. In addition to our trusted Solutions Exchange partners, we can offer custom API connections.

Real-Time Data

Real-time data access, 24/7 with full visibility and access to all your production data, anytime you need it.

Infrastructure as Code

Full traceability and reproducibility.

Backups

High-resolution backups of all data down to the minute for the past 90 days

99% Uptime

With best-in-class performance.

Authentication

Best-in-class authentication with multi-factor, single sign on and more.

Security

Encryption, gateways, firewalls and more included.

Modular Solutions Insurance Software Frequently Asked Questions

How would this platform benefit my business?

The Modular Solutions platform benefits MGAs, insurers and mutuals, and brokers with programs by providing them with a single platform to manage their entire operations. Our insurance software provides scalability, responsiveness, configurability while remaining affordable and without requiring any code or developers. Your business can improve efficiency and productivity, reduce costs, and provide innovative and effective policy administration, claims management, direct-to-consumer sales and more in one place.

What types of insurance policies can be managed using this platform?

Modular Solutions can be used to manage any property and casualty insurance policy, including personal lines, commercial lines and specialty lines. We manage everything from simple package and program policies to large, complex and customizable products.

Some examples of current offerings from Modular Solutions clients include: home, vacant home, auto, recreational vehicles, D&O, CGL, E&O, farm (including large Hutterite colonies), large commercial package policies, specialty including hole-in-one, earthquake deductible, and association programs. And so much more.

We do not support benefits policies as this time.

What are the key features of the platform?

Here are the key features of the Modular Solutions insurance software:

- Affordable – Our pricing is competitive, and our platform helps you reduce overall costs

- Automated – Streamline your processes and workflows with automation to improve efficiency and reduce FTE and overhead

- Configurable – Design your products and interfaces as you want them with unparalleled configurability

- Holistic – We’re a single solution insurance software, which means you can manage all aspects of your operation and the full policy life cycle in one place

- Data-driven – You’ve got full access and control of your data, allowing you to develop advanced reporting and analytics and make data-driven decisions

- Integrated – Maximize your functionality with third-party API connections

- Responsive – You can make real-time changes to adapt to the market

- Secure and Scalable – Through cloud-hosted, service-based architecture, your business benefits from exceptional security and scalability

- User-friendly – Our interfaces are customizable and user-friendly with no programming required

Each module has its own key features and benefits – visit the individual module pages to learn more.

Does this platform use AI?

Yes, the Modular Solutions platform uses AI where it is secure, sustainable, and beneficial to our internal teams and clients. In 2026, we launched an embedded AI assistant named Modi. One of this AI-powered assistant’s functionalities is quote and claims submission ingestion. It automatically ingests emailed and PDF quote and claims submissions, eliminating manual data entry and improving speed of intake. This improves client responsiveness and satisfaction while increasing efficiency of your staff or broker partners. We’re continually evaluating AI opportunities for innovation and rolling out new features.

For full details on our AI use, please visit our AI webpage.

Can the platform integrate with other systems and software?

Yes, you can view a full list of systems and software we integrate with our solutions exchange page.

Is the platform user-friendly for both administrators and customers?

Yes, that’s one of the advantages of choosing Modular Solutions. All of our modules require zero coding and have an excellent, user-friendly and configurable interface for administrators, broker partners and even clients in our gateway+ portal.

Are there any customization options available for different insurance products?

Yes, our Product Module allows you to fully configure the most complex insurance products. Insurance products are built individually end-to-end in our Product Module and should any custom development be required, we can facilitate those needs.

How does the Modular Solutions insurance platform ensure data security and privacy?

Our platform is PCI compliant and follows all best practices for data security and privacy, including geo-replication and high-availability services, high-resolution backups, data encryption, user authentication, gateways, firewalls, advanced threat protection and more.

How is data backed up and recovered in case of an emergency?

Modular Solutions offers our clients high-resolution backups of all data sources down to the minute for the past 90 days with multiple long-term data retention options. We also provide support for data loss prevention and disaster recovery.

How long does it take to implement the platform?

The length of time it takes to implement the platform will depend on the number and complexity of your insurance products. Generally, we like to get our clients live in the platform in 12-18 months.