At Modular Solutions, we use artificial intelligence (AI) where it delivers real value while remaining secure, responsible, and sustainable. AI is one of many tools helping us advance our vision of enabling the best insurance experience in the world, supporting insurers, MGAs, brokers, and policyholders through smarter automation and more efficient workflows.

Our AI initiatives focus on two core areas: embedding AI into our policy administration system to deliver value to clients and and improving our internal development and product build processes. Together, these efforts allow us to deliver reliable innovation and better experiences across the insurance lifecycle.

Our AI Philosophy

At Modular Solutions, our vision is to enable the best insurance experience in the world. Innovation and technology are central to delivering on that vision, with AI being one of several tools helping us get there.

AI is incredibly powerful, but it’s also a term that has often overpromised and underdelivered across the industry. It introduces real consideration around data security, regulatory compliance, and long-term maintainability. That’s why we take a practical, disciplined approach to AI adoption.

At Modular Solutions, we use AI where it is:

- Beneficial to our clients and internal teams by improving workflows, efficiency, and outcomes.

- Secure and compliant, meeting expectations of our clients, regulators, and general industry standards.

- Sustainable for long-term value and innovation without increasing risk or complexity.

These principles ensure AI supports the trust, reliability, and performance our clients trust our platform with every day.

Dedicated AI Expertise & Long-Term Commitment

In 2025, we invested in building a team dedicated to artificial intelligence, hiring specialists focused on applying AI thoughtfully within the Modular Solutions platform. Their role is to explore, build, and refine AI capabilities that deliver tangible value to insurers while respecting the realities of security, compliance, and scale.

Beyond product development, we also use AI strategically within select internal processes to help keep our platform efficient, sustainable, and affordable for our clients. This includes improving how we build, test, and evolve our software which allows us to innovate responsibly while maintaining the stability insurers expect.

How Modular Solutions is Using AI Today

Modular Solutions uses AI both internally and within our policy administration platform to improve efficiency, accuracy, and delivery of outcomes.

Internally, AI supports our development and product teams, helping us build, test, and deliver software more efficiently. For our users, AI‑powered features embedded within the Modular Solutions platform streamline critical insurance workflows and reduce manual effort across quoting and claims processes.

In early 2026, we introduced Modi, our embedded AI assistant, beginning with AI‑powered document ingestion for quote submissions. Additional AI capabilities will roll out throughout 2026, further enhancing speed, accuracy, and usability for insurers, MGAs, brokers, and policyholders.

Embedded AI Assistant Features & Functionalities

Modi is our AI assistant, embedded directly within the Modular Solutions platform to support users in completing complex tasks more efficiently.

Modi uses AI to reduce manual effort, improve accuracy, and streamline workflows. Rather than replacing human expertise, Modi enhances it by handling repetitive steps, processing large amounts of information quickly, and surfacing relevant data at the right time.

Throughout 2026, we will continue expanding Modi’s capabilities, with planned functionality including:

Document Ingestion for Quoting – Quote submissions document ingestion to accelerate quoting and underwriting workflows.

Document Ingestion for Claims – Claims submissions document ingestion for faster and more accurate intake.

Actuarial Analysis – To support data‑driven decision‑making, rating, and risk management

Wordings Analysis – To improve clarity, consistency, and compliance.

AI-Powered Document Ingestion

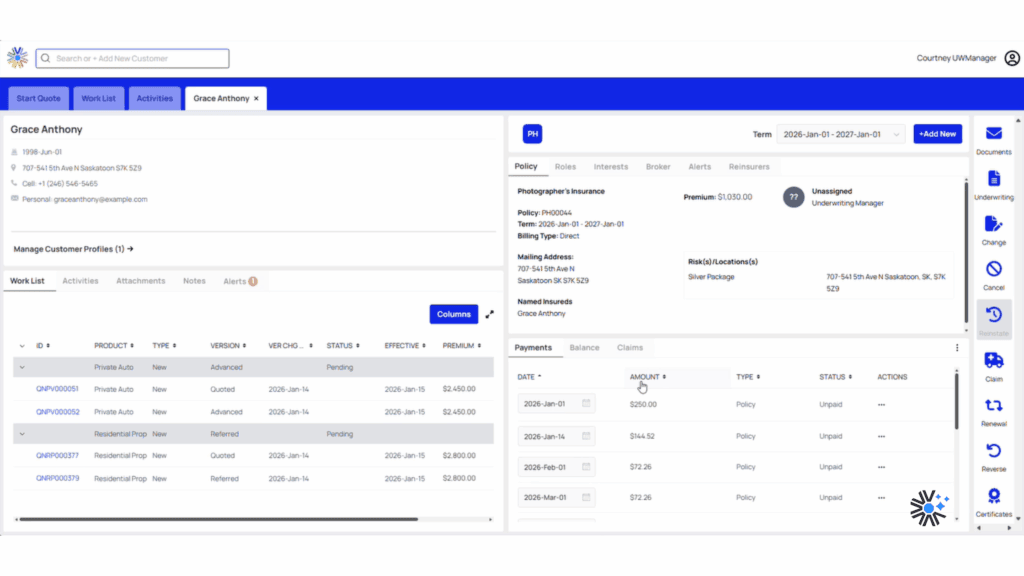

At the core of Modi’s current capabilities is an AI‑powered document ingestion service, built specifically for insurance workflows and integrated directly into the Modular Solutions platform.

Users can simply upload or drag‑and‑drop documents, and Modi handles the rest:

- Intake of multiple document formats, including PDFs, Word documents, emails, and more

- Automatic classification of document types, such as quote submissions or claims

- Data extraction from submitted documents

- Validation and exception handling, flagging missing or inconsistent information

- Data synchronization, securely pushing extracted data into the appropriate client record

A quote submission can be generated in real time. For claims submissions, a claim can be automatically created, significantly reducing processing times. The ingested document is also automatically attached to the client record and an activity is created.

This AI‑driven automation improves quote and claims submission speed, increases accuracy, and enhances overall efficiency. Staff and broker partners spend less time on manual data entry and more time focusing on customer service and insurance-related decision-making, delivering a better experience for everyone involved.

This feature will be fully rolled out in 2026. For more information on our AI-powered document ingestion tool, please visit this page.

Development & Product Build Automation

Behind the scenes, AI tools help our development and product build teams work more effectively and sustainably. These capabilities allow us to continuously improve the Modular Solutions platform while maintaining affordability.

AI-driven tools help our development teams:

- Ship faster, higher quality code.

- Improve and automate test coverage and quality checks.

- Accelerate feature delivery and enhancements.

- Maintain efficiency to keep our platform affordable and sustainable.

AI assists our product building teams:

- Build products faster and with more accuracy.

- Test products thoroughly, faster.

- Improves product building capacity and timelines for clients.

While these improvements are largely internal, they translate directly into benefits for clients such as more frequent enhancements, greater platform stability, and affordability.

Modular Solutions AI Roadmap

Our AI roadmap is focused on practical, incremental innovation that builds on the foundation established with Modi and expanding AI capabilities where they meaningfully improve insurance workflows.

Following the launch of Modi with AI‑powered document ingestion, our 2026 roadmap includes expanded capabilities such as actuarial and wordings analysis, further enhancing data accuracy, risk management, decision‑making, and consistency across the policy lifecycle.

As with all our AI initiatives, additional capabilities will be introduced thoughtfully and only where they align with client needs and regulatory realities.

How AI Benefits Our Clients

Our approach to AI delivers both direct and indirect value to insurers, MGAs, brokers and policyholders, including:

- Faster quoting and policy issuance through automation and intelligent document processing

- Reduced operational costs by minimizing manual data entry and rework

- Improved accuracy and compliance, supporting regulatory and underwriting requirements

- More frequent platform updates and enhancements driven by increased development efficiency

- Higher reliability and security, ensuring AI strengthens rather than risks core insurance operations

By prioritizing trust, transparency, and long‑term value, our AI roadmap supports continuous improvement, helping insurers, MGAs, and brokers innovate, adapt, and thrive.

Our Commitment to Responsible AI

At Modular Solutions, responsible AI is non‑negotiable. Every AI capability we build or deploy is held to strict standards for data privacy, security, and regulatory compliance, reflecting the trust our clients place in us as a core insurance technology provider.

We are committed to transparency in how we use AI including clearly communicating when AI is involved, what it does, and how it benefits our clients. Our goal is not to replace humans, but to enhance your staff’s capabilities with tools that improve efficiency, accuracy, and decision‑making across the insurance lifecycle.

AI is one part of our broader innovation strategy to empower insurers, MGAs, and brokers and enable the best insurance experience in the world.

Discover What AI Can Do For Your Insurance Operations

Discover how our AI‑powered solutions can help streamline workflows, reduce complexity, and improve the insurance experience for your team and customers.

Contact Us