Reduce administrative data entry, improve quote turnaround, and issue policies faster with AI-powered document ingestion built into our embedded AI assistant, Modi. By eliminating manual data entry and rework, teams improve accuracy and efficiency, resulting in better sales and happier clients.

See it in Action

See it in Action

The Challenge with Manual Quote & Claim Submission Processes

Underwriting teams and broker partners spend too much time doing manual data entry and handling quote and claims submissions. Inconsistent document formats, emailed attachments, and the use of PDFs force teams into time-consuming manual data entry, slowing down the entire process.

This manual approach results in:

- Missed sales when quote submissions aren’t processed or completed in time

- Slower quote turnaround and policy decisions

- Delays in the claims submission and processing lifecycle

- High error rates that drive rework and downstream corrections

- Frustrated broker partners and dissatisfied clients

The AI-Powered Solution

As part of our platform’s embedded AI assistant, Modi, our document ingestion tool removes bottlenecks across underwriting, quoting, and claims by capturing accurate data at the source. Documents are automatically read, classified, and transformed into structured data in the Policy Module (for underwriters) and the Gateway Module (broker portal for broker partners). The ingested document is attached to the client record and an activity is automatically generated for tracking and audit purposes. This drastically speeds up the quote and claims submission processes, reduces rework, and frees teams to focus on higher-value work.

Modi and the document ingestion tool will be rolled out in 2026 in the Modular Solutions platform.

Quote & Claim Generation

Modi can generate a complete quote or claim directly from the ingested document. This eliminates further manual work and dramatically increases the number of submissions processed without adding staff.

This functionality will be rolled out in 2026.

Benefits of AI Document Ingestion

The benefits of document ingestion through our new AI assistant include:

- Faster customer response times

- Improved operational efficiency

- Increased quote throughput and sales performance

- Scalable growth without increased overhead

- Reduced costs

- Stronger data accuracy

- Built-in validation and traceability to support audit and compliance requirements

Transform processes that once took hours – or days – into minutes, where speed directly drives sales and customer satisfaction.

How AI Document Ingestion Works in Modular Solutions

Our AI-powered document ingestion fits seamlessly into our platform through our embedded AI assistant, Modi. The tool integrates into your policy administration workflows, automating what you need, when you need it.

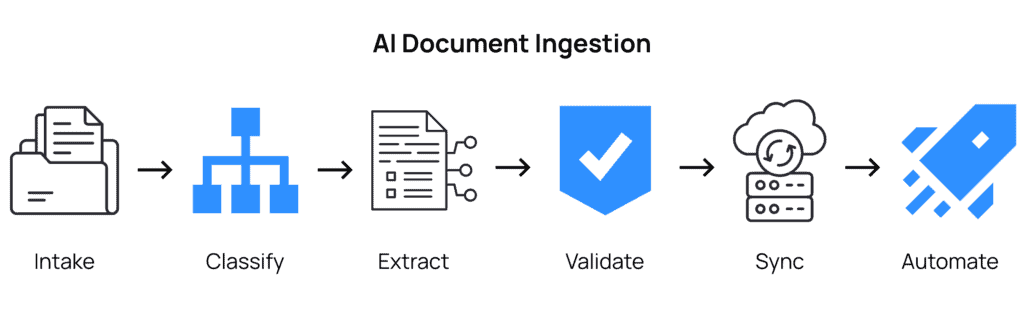

Here’s how it works:

- Document Intake – Ingests documents from multiple sources including PDFs, emails, word documents, scanned files, and more.

- Classification – Automatically identify and categorize document type such as quote submission or claims submission.

- Data Extraction – Extract data fields with high accuracy.

- Validation & Exception Handling – Validate the extracted data, apply confidence scoring, and flag exceptions to reduce errors, rework, and downstream corrections.

- System Sync – Push verified data directly into the policy records.

- Automation – The ingested document is automatically attached to the client record and an activity is also created. Modi will also be able to automatically generate a full quote or claim, further accelerating quoting and claim submission workflows.

AI Document Ingestion Features Designed for Insurance

Modular Solutions has insurance industry veterans that truly understand the industry and workflows. Modi has been been rigorously trained and designed based on this extensive experience and expertise.

Insurance-Specific Data Extraction

Our document ingestion tool is specifically designed for:

- Quote submissions

- Claims submissions

It can be used throughout the policy lifecycle for new business, endorsements, mid-term changes, renewals, and claims.

It is trained on your quote submission and claim submission process, making it possible to automatically generate quotes and claims if all required fields have validated data. Data validation and error flags for missing fields or unreadable data maintain underwriting and compliance standards.

Full Platform Integration

Our embedded AI assistant, Modi, and its document ingestion tool will be fully integrated into the Modular Solutions platform:

- No third party accounts required

- No need to navigate to another window or system

- As Modi is an embedded AI assistant, it is fully secure in the Modular Solutions environment.

- Works directly within your policy and claims administration workflows

- Fully integrated into our Gateway Module (broker portal) for broker partners

Built for Insurance Teams Valuing Efficiency & Accuracy

AI-powered document ingestion delivers tangible value across every role involved in quoting, policy issuance, and customer service. It removes friction while improving speed and data quality.

Underwriting Teams – Accelerate risk review and the quoting process by eliminating manual document handling and data entry. Underwriters receive clean, structured data directly from submitted documents, enabling faster, more confident decision-making with fewer errors and less rework.

Front-Line Brokers – Reduce backlogs and move deals forward faster. Automated document ingestion simplifies quote submissions, shortens turnaround times, and accelerates policy issuance which helps brokers respond quickly and win more business. It also assists with speeding up the claim submission process, improving customer satisfaction.

Customers – Experience faster responses and smoother interactions. Whether submitting information for a quote, endorsement, or claim, customers benefit from reduced delays and quicker outcomes. Overall, this improves satisfaction and trust.

Insurance Executives – Lower expenses while supporting scalable growth. By automating manual processes and improving straight-through processing, AI-powered document ingestion reduces operational costs, increases throughput, and creates a foundation for sustainable, profitable growth.

Enterprise-Grade Security & Compliance

At Modular Solutions, we leverage AI only where it is secure, sustainable, and beneficial. Once fully rolled out, this AI-powered ingestion tool will meet these requirements and as it integrated into the platform itself, you maintain enterprise-grade security and compliance with:

- Role-based access controls

- Customer data is never used to train, fine-tune, or improve shared AI models

- No data retention beyond the scope of the ingestion request and processing lifecycle

- AI inference occurs within controlled enterprise boundaries, not public consumer AI services

- Clear data ownership. You retain full ownership of all inputs and outputs

- Configurable safeguards to prevent unauthorized prompts, data leakage, or misuse

- Alignment with enterprise AI governance, privacy, and responsible-use standards

AI Document Ingestion FAQs

Can the AI document ingestion tool handle emailed submissions?

Yes. The AI document ingestion tool can process documents received via email, including attachments such as PDFs, Word files, Excel spreadsheets, and scanned forms.

Today, ingestion is typically initiated through a secure drag-and-drop experience inside the platform. Email-based workflows are fully supported and will continue to evolve as part of the broader ingestion pipeline.

Can the AI document ingestion tool handle handwritten or scanned documents?

Yes. The system can process scanned and handwritten documents, including application forms and supporting materials.

That said, handwritten content may require additional validation compared to digitally generated documents. The platform is designed to flag lower-confidence fields so users can quickly review and confirm the extracted data.

How is this AI tool different from OCR?

Traditional OCR focuses on converting text from images into machine-readable words. AI-powered document ingestion goes significantly further.

Instead of just reading text, the system understands document structure and context. It identifies insurance-specific data points, interprets meaning, and maps information directly into structured fields aligned with your products, coverages, and rating logic.

This eliminates manual re-keying and dramatically reduces the time required to move from document submission to quote generation.

How long does implementation of this tool take?

Once enabled, users can begin ingesting documents immediately. The AI document ingestion tool is natively integrated into the Modular Solutions platform. There is no separate system to deploy or maintain.

It follows the same role-based access controls, product rules, and permission models already in place. You can enable or disable access by role, user group, or product, ensuring the tool is only available where appropriate.

What is AI-powered document ingestion for insurance?

AI-powered document ingestion for insurance automates the intake of unstructured documents such as applications, submissions, and supporting materials.

The system reads documents, extracts relevant data, maps it to product definitions, and automatically populates quote and policy fields within the platform. This reduces manual effort, accelerates turnaround times, and allows brokers and underwriters to focus on decision-making rather than data entry.

The outcome is faster quotes, lower operational cost, and a more scalable insurance workflow.