Experience an unparalleled policy administration software for insurers, mutuals, managing general agents (MGAs), and brokers with programs. Manage your policyholders, underwriting and day-to-day work management throughout the entire policy life cycle with our comprehensive Policy Module. Developed by insurance professionals for the industry, this innovative software is affordable and powerful. Our automated, streamlined processes make work faster and easier, allowing for increased productivity and client satisfaction with reduced overhead for your business.

Book a Demo

Book a Demo

Key Features & Functionality

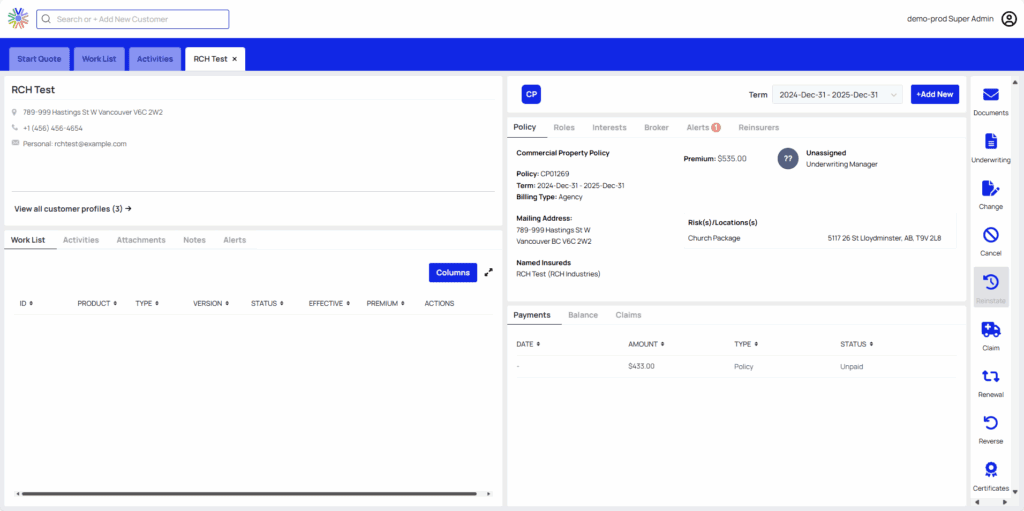

The Policy Module is where your team’s daily operations happen. It is the command centre for managing the full policy lifecycle including quotes, underwriting, payments, renewals, cancellations and more. Drag-and-drop functionality and user-friendly interfaces make it quick and easy for staff to use the module. Use an AI-powered quote and claims submission ingestion tool that automatically captures and validates data from emailed and PDF submissions, reducing manual effort and accelerating intake. The Policy Module key features and functionalities include:

Quote Submission

Prepare, present, retrieve, review and issue quotes. Use Modi, our embedded AI assistant with a document ingestion tool to automate emailed and PDF quote submissions, eliminating manual entry and speeding up the quote intake process.

Underwriter Referral

Review underwriter review submissions (submitted based on rules or manually), where the underwriter can amend, accept or decline.

Cancellations

Send a registered letter, override returned premium, set prorate or short rate, and determine minimum and fully retained premium.

Claims

Real-time sync on claim status, payments, and adjuster; track incurred claims and claims by claimant for future underwriting. Leverage our AI-powered claims submission tool to eliminate data entry and speed up the claims submission process.

Work List

View and manage work items with advanced sorting and filtering options, assign users, set follow-up dates, and close (with reason).

Manage Balances & Payments

Change payment date method or plan, process payment manually, write-off to bad debt or goodwill and add money down or buyout financing.

Download & View Attachments

Including quote proposals, applications, disclosure letters, declaration pages, wordings, registered letters, proof of insurance and more.

Reverse

Targeted or sequential reversals with the option to suppress or include documents.

Reinstatements

Reinstate policies along with their financing.

Automated Updates

When you update your product (in the Product Module), rates, rules, definitions and wordings are automatically updated in the Policy Module.

Renewal Flags

Flag renewal for review – then release, release with changes, or lapse.

Manage & Configure

You can manually rate coverage, configure auto-renewal, manage additional interests and narratives (add additional information for rules, rates and certificates), manage and set alerts, control visibility of notes and attachments, and more. We also offer weighted rating factors for mid-term changes.

Drag & Drop

Drag and drop attachments to policyholder, policy and quote.

Broker Transfer

Easily transfer from one broker code to another.

Role-Based User Interface

Create multiple custom user interfaces based on roles.

Colour Coding

Quickly identified policies based on status with colour-coded indicators.

Enhanced Search

Find the correct contact or policy with enhanced search capabilities. We also offer enhanced additional interests search.

In addition to the everyday work list and role-based interface, we also offer four unique views:

- Notes view – sort or filter by 11 different parameters and export the data.

- Broker view – Broker contact, code and office by policy.

- Roles view – Overview of roles assigned to policy version to optimize customer service.

- Reinsurer view – Overview of subscription by policy version.

Designed for efficiency by insurance industry professionals. Built for you:

Benefits of the Policy Module

Our policy module is a policy administration system that will benefit MGAs, insurance companies, mutuals and brokers with programs with its:

Automated and Streamlined Processes

Automate routine tasks and experience improved workflows to save time and reduce errors, enhancing operational efficiency and reducing overhead.

Innovative Technology

Leverage our cutting-edge technology designed specifically for the insurance industry to stay competitive. We continually innovate to improve our platform, leveraging AI, automation, API connectivity, and more to bring value to our clients.

User-Friendly Interface

Tired of legacy interfaces that are difficult to navigate? Enjoy an intuitive and easy-to-use interface which helps adoption and training with your staff.

Scalability & Flexibility

Our Modular Solutions platform is completely configurable and adapts to the changing needs of your business – it’s a solution that grows with you and can be customized to fit your unique requirements and workflows.

Want to see the Policy Module in action?

Leverage Integrations with the Solutions Exchange

Seamless API connections to our Solutions Exchange partners extend your capabilities with the Modular Solutions platform.

Learn more about the Solutions Exchange here >

Policy Module Frequently Asked Questions

Here are the answers to some of our most frequently asked questions about the Policy Module.

What specific features does the Policy module offer for managing policyholders and underwriting processes?

The Policy module enables you to manage the entire policy lifecycle, including underwriting processes.

Starting with the quote submission, you can prepare, present, retrieve, review and issue quotes.

Underwriters receive underwriter referrals (manually or automated based on rules) and they can amend, accept or decline as well as override coverage dates, premiums, commissions and taxability. They also have the power to manually rate coverages.

Renewals can be automated or done manually. You can also flag renewals for review with the option to release, release with changes or lapse.

The system also handles endorsements, cancellations and reinstatements.

Furthermore, staff has an excellent work list where they can view and manage their assigned items, set up follow ups, close items, sort and filter through their tasks, and access the work item or policyholder directly. They can also set alerts, add notes, assign items to other internal or brokerage employees, drag and drop attachments, generate documents, and manage balances and payments.

Can the software handle multiple types of insurance policies?

Modular Solutions is built for all property and casualty insurance policies including personal, commercial and specialty lines. It can handle many policy lines for a single policyholder. It does not currently support benefits policies.

Does Modular Solutions support automated policy renewals and cancellations?

Yes, renewals and lapses on renewal (cancellations) can be automated.

Can it integrate with third-party applications, such as CRM or accounting software?

Yes, Modular Solutions seamlessly integrates with many third-parties. Our Solutions Exchange lists our current integration partners but don’t hesitate to reach out to our team if your preferred partner isn’t listed – we may be able to make it happen!

How easy is it to migrate data from our current system to this new software?

It depends on your current system. Our team assists you with this process to ensure the data that your need is imported into the Modular Solutions platform.

Is the software user-friendly and intuitive for all staff members?

The Modular Solutions platform was designed by insurance professionals for the industry to be as intuitive and easy to use as possible to improve efficiency and reduce frustration. Many legacy platforms are difficult to use and require a lot of clicks – we’ve tried to minimize that with our Policy module.

How can my remote workers access the platform?

Our platform is cloud-based which means it can be accessed via the internet.

Are there any dashboards and reporting tools?

Yes, we offer dashboards and reporting in our Intelligence Module.

How does the software ensure the security of sensitive policyholder information?

We help ensure the security of policyholder information through offering advanced threat protection, best-in-class user authentications, restricting permissions, data encryptions, hosting within Canada, gateway protections and firewalls. For a full overview of our data security measures, please contact our team.

Can the software scale with our business growth?

Yes, whether you have 100 policyholders or 1,000,000 policyholders, our Modular Solutions platform will scale with you. You get the platform’s full functionality from day one so there’s no need to upgrade as you grow.

Does the Policy Module leverage AI?

Yes, the Policy Module leverages AI where it is beneficial, secure, and sustainable. We have an embedded AI assistant named Modi. One feature of Modi is a document ingestion tool. This feature takes emailed and PDF quote and claims submissions and inputs them into the system, eliminating manual data entry and speeding up the process significantly. We continue to evaluate AI opportunities and add AI features to our platform.